Internship Report on Civil Bank Limited (CiBL), Nepal

CHAPTER

ONE

INTRODUCTION

1.1 Background

The scope of BBA has

grown as an important academic discipline with practical dimension. This has

grown according to needs of the institutions with the growth of financial

sectors in particular and other professional organizations in general.

In the present day world,

people are becoming more knowledge oriented in relation to practice in the real

life situation of problem-solving. Due to this reason, many schools and

colleges are emerging year by year. Among the various universities, Tribhuvan

University (TU) is the largest and oldest university of Nepal. Bachelor in

Business Administration (BBA) is one of the demand driven management courses

among different management courses of TU to makes students not only brilliant

in the pursuit of knowledge but also practical to behave in the decision-making

process.

BBA is 4 years complete

program course of making students eligible for BBA degree and this program is

instituted to develop socially responsible, creative and result oriented

management professionals to fill up the middle-level managerial positions in

the rapidly growing business sector in Nepal as well as aboard. The interest in

BBA is increasing day by day because it is accepted worldwide as it covers the

International standard of four years (one hundred and twenty credit hours)

course in developing professionalism to make the students of today as the

future stars of the nation building.

Moreover, students studying this course are evaluated on the basis of

the grading system and it has a facility of semester system which includes 8

semesters. A single semester is completed within six months.

1.2 Importance of Internship

Since theoretical

knowledge is not sufficient in this competitive environment, in the 8th

semester of BBA program, students are required to work in the financial

institution for at least eight weeks where they can experience real work

environment. It also helps in understanding organizational environment and

culture. Internship program enables in acquiring skills and techniques by experiencing

practical work situations directly applicable to develop the career on

financial sectors. In some situation, internship program also helps in getting

the job in host organization or other organization.

1.3 Objectives of Study

Every action is directed

towards accomplishing certain objectives. The objectives are the things that we

are planning to achieve. It may be things, skills, qualities, knowledge etc.

Setting objectives helps to understand and analyze how our actions need to be

directed. It basically helps to answer the question how to achieve our larger

target. Well, internship program is in itself a new learning pedagogy which

provides the floor for the practical exposure of theoretical knowledge,

however, the objectives of the study and making the report are:

• To understand how theoretical concepts are

implemented practically in the working procedures of financial institutions

• To understand the banking organization, its

structure, culture, norms, working procedures and risk associated with it

• To attain the performance done and gain skills

in handling functions of different Department of Banking industry

• To gain knowledge on functioning of credit

department of commercial bank

1.4 Methodology

1.4.1

Organization Selection and Placement

Being a BBA student

specializing in “Finance”, doing an internship in “A” class financial

institution is always in a top priority. Nevertheless, selecting an

organization has been a tough job because much of time was spend on searching

the right institution for me. Internship from a reputed financial institution

helps to build the career by creating linkage between classroom knowledge and

practical business world experiences. So by going with the trend, I applied for

the internship in some financial institutions. Fortunately, I got an

opportunity to work in civil bank limited.

1.4.2

Duration of Internship

The duration of

internship has been defined for the minimum of eight weeks. The internship was

conducted from 4th June 2012 to 3th August 2012 under the supervision of Mrs.

Sharmila Bista, Credit Department Head, and New Road Branch. During my 8 weeks

of internship, I was assigned to work in the following department:

Table

no. 1.1: Duration of internship

Name of

Departments

|

||||

No.

of weeks

|

CSD

Department

|

Marketing

Department

|

LC

Department

|

Credit

Department

|

1-2

|

||||

3-4

|

||||

5-6

|

||||

7-8

|

||||

1.4.3

Sources of Data Collection

Sources of data

collection refer to the way of acquiring the related information from different

sources. By directly involving in the banking institution as an intern the

following primary sources and secondary sources of data collection:

Primary

Source:

• Direct personal interview with the related

staffs

To collect the necessary

information for this report asked many structured, unstructured and practical

questions to the relative staffs of the branch.

• Unstructured

interview with the clients

Clients are also the

source of information and they provide the information based on their

perception towards the products and services. Visiting of different clients for

marketing purpose helps a lot for acquiring information and perception from

existing clients about the bank products and services.

Secondary

source:

• Visited the various web site of civil bank

and other commercial banks

• The articles and magazines are the other

secondary source through which necessary

information are acquired

• The brochures and the annual report of

Civil Bank Ltd

1.4.4

Activities Performed in the Civil Bank Limited

This section includes the

study based on the internship period and the various tasks performed during the

stay in the bank for 8 weeks. The following are the activities which interne

performed, as an intern, in the bank:

Credit

Department:

• Prepared checklist of original documents

and other necessary documents while providing loan

• Filled missing information of clients in

the documents

• Checking property details of clients

• Observed the process of verification of

name and address of SME customers, limit, area of mortgaged property in the

mortgage deed with that of ‘Lal Purja’ provided by customer

• Checking whether the Current market Value

or Distress Value in the valuation report is sufficient to meet the limit

• Stock visit of the clients

• Calculate various ratios from the provided

balance sheet and income statement for analyzing the health of the firm

Customer

Service Department:

• Account opening (Personnel and Corporate)

• Issuance of Debit card and cheque book

• Balance inquiry and other information about

the bank service

• Providing information about products to the

customers

• Issuing of account statements and balance

certificate

• Solving the queries of the customers.

Letter

of Credit Department:

• Providing Forms of Letter of Credit

• Checking documents like: invoice, packing

list, legal documents, date of shipment etc

• Doing photocopies, fax, scanning of

documents

• Filling the Bi.Bi.Ni.Fa.No.4

• Keeping records of documents received

manually

• Preparing

NRB checks

• Recording of documents received from the

sender of goods

• Filing of documents according to LC no. and

branch code

Remittance

Department:

• Observe the procedures for fund transfer in

domestic and international network

• Help the customer to fill their form for

receiving the money as well as sending money

• Observe the procedure for preparing drafts,

managerial checks, travelers check, outward clearing of checks

• Help the customer for opening fixed deposit

in the bank

Marketing Department

• Dealing with customers directly for

acknowledging them about the banking products and services

• Participate in new loan product survey

namely “SME loan survey” at Peoples Plaza, and Pashupati Plaza.

• Visited various Gold account Customers to

inform about new product of the bank

1.5 Scope of the Study

The scope of the

undertaken project is supposed to be wider in terms of the following points:

• Expansion of the horizon of knowledge of

interns

• Practical learning through the exposure of

various task related activities

• Helps in shaping the future career

1.6 Limitation of the study:

Despite most of the

efforts undertaken to make my project more realistic, practicable in terms of

Nepalese context, there are certain limitations of my study:

• Internship time period was not sufficient

enough to gain much of banking knowledge

• Information about the banking business is

strictly confidential

• The access to the system is strictly

prohibited to the interns

• This study may not be applicable to other

organization of similar nature

CHAPTER

TWO

INTRODUCTION

TO THE INDUSTRY

2.1

Introduction of Bank

A bank may be defined as

an institution which deals in monetary transaction. It is a financial

intermediary which works as a bridge; fills the gap of fund between lenders and

borrowers (entrepreneurs). Bank draws surplus money from the people who are not

using it at the time (having excess money) and lend to those who are in a

position to use it for productive purposes. It creates credit and also provides

exchange facilities to the public. the So, bank is also known as a factory of

credit production.

The bank pays a certain

amount of money as interest, on the money they have borrowed. Similarly, they

charge interest on the money lent. Interest is always calculated in certain

rate percent per annum. The rate of interest on loans advanced is always

greater than that on deposits. The difference between the two rates is the

bank’s margin of income.

Some definitions of banks

are:

“Bank is a financial

institution, which provides financial services that may be in the form of

accepting deposits, advancing loans, providing necessary technical advice,

dealing over foreign currencies, remitting funds, etc.”

Nepal Rastra Bank Act

2002

“Banks are financial

institutions that fund in the form of deposits, repayable on demand or in short

notice.”

World Bank

From the above

definitions, it is clear that a bank is a financial institution, which accepts

deposits from the public in different accounts and grant loans to individuals

and corporations against their certain securities. In these days, it performs a

wide variety of functions. It does lot more than deposit and credit such as

remitting money, letter of credit, guarantee, etc, for the service and benefits

of individuals, corporations and general public .i.e. it is an agent of its

clients, which remits money, provides services like LC, guarantee etc. and

collects incomes, commissions and pays expenses on behalf of them.

2.2

Origin of Bank

The banking concept is as

old as authentic history. The word ‘bank’ is derived from the Latin word

‘bancus’ which means bench. In the ancient time, the Italian goldsmith used to

sit on the benches when they were in work of exchanging of money; trading of

gold and silver. The word bench means ‘Banck’ in German, ‘Benca’ in Italian and

‘Banquee’ in French, from which it is used as ‘BANK’ in The English Language.

The following functions

were in use even in the second millennium in Babylonia, but the deposits were

not of money but of cattle, grain or crops and eventually precious metals.

Nevertheless, some of the basic concepts underlying in today’s banking system

were present in the ancient arrangements. Deposits were accepted, loans were

made and borrowers paid interest to the lenders.

The history of modern

banks starts from the establishment of Bank of Venice, established in Venice,

Italy in 1157 AD. Subsequently, Bank of Barcelona (1401) the and bank of Geneva

(1407), Bank of Amsterdam (1607) the and bank of Hamburg (1619) were established.

The ‘Bank of England’, first English Bank, was established in 1964 A.D. The

bank of Hindustan established in 1770 A.D. is regarded as first bank in India.

But these banks were not established according to law. In 1833 A.D., Banking

Act 1833 was introduced in United Kingdom which allowed operating Joint Stock

Company Banks. With the expansion of the commercial activities in the northern

Europe, there sprang a number of private banking houses in Europe and slowly

spread throughout the world.

2.3

Importance of Bank

The Bank accepts deposits

of spare money from its customers. The deposits are utilized the for

formulation of capital in the productive sectors like industry, trade and

service area of the country. The bank issues different types of credit instrument

such as bank draft, letter of credit, credit cards and telegraphic transfer

(T.T.). These credit instruments facilitate fast and safe remittance of money

from one place to another.

• Banks finance priority sectors, thus

helping in economic development of the country

• Bridge the gap between surplus and deficit

unit.

• It offers different types of loans and

advances enabling manufacturers to undertake new ventures, adopt new techniques

and introduce new means of production

• It provides various card services, which

has eliminated the difficulties and risks of carrying

• Facilitate the customers with new and

advanced products

2.4

Banking Sector in Nepal

The history of Nepalese

banking industry is not so long. The origin of modern banking dates back to the

ancient times. However, in the context of Nepal, the concept of modern banking

has emerged recently.

Modern banking system in

Nepal started from the establishment of Nepal Bank Limited (NBL) in 1937 A.D.

under “Nepal Bank Act, 1937”. It is the first bank in Nepal. Nepal Rastra Bank,

the Central Bank of Nepal, was established in 1956, to discharge the central

banking responsibilities including guiding the development of Financial Sectors

in Nepal. Another commercial bank, Rastriya Banijya Bank (RBB), was established

in 1965 A.D, realizing NBL alone couldn’t extend adequate service to the

country in terms of commercial banking. After the establishment of RBB, no new

commercial bank was established for a period of nearly 18 years.

To promote healthy

competition among banks, commercial Bank, Act 1974 was amended in 1974. The new

policy allowed joint venture banks with foreign collaboration to operate in

private sector with the objective of introducing modern banking practices and

widen the financial structure. With the introduction of this policy, different

commercial banks were established.

Financial sectors in

Nepal have become one of the major contributors to the Nepalese Economy. There

has been a rapid growth in the Financial Institutions in the recent years. The

present scenario of Nepalese Financial Institutions can be presented as:

Table

no. 2.1: No. of financial institution in Nepal

Type of Financial Institution

|

Class

|

Number

|

Commercial Bank

|

A

|

32

|

Development Bank

|

B

|

83

|

Finance Companies

|

C

|

79

|

Micro Credit Development Banks

|

D

|

19

|

Saving and Credit Co-operatives (Licensed by NRB)

|

N/A

|

16

|

Non Governmental Organization (Licensed by NRB)

|

N/A

|

45

|

Total

|

274

|

|

(Source: www.nrb.gov)

2.5

Introduction of Commercial bank

A commercial bank is a

type of financial institution and intermediary. It is a bank that provides

transactional, savings, and money market accounts and that accepts time

deposits.

It is an institution

which accepts deposits, makes business loans, and offers related services.

Commercial banks also allow for a variety of deposit accounts, such as

checking, savings, and time deposit. These institutions are run to make a

profit and owned by a group of individuals. The number of Commercial Banks has

increased from 25 in 2009 to 32 in 2012, offering wide varieties of products

and services.

2.5.1

The Role of Commercial Banks

The modern commercial

banks have played the major role in every sector of the economy. The role of a

typical commercial bank can be explained with the figure as follows:

Figure

no.2.1: Role of commercial banks

2.5.2

Growth rate of commercial bank in Nepal

The development of

commercial banks in Nepal and their growth rate can be explained with the

figure as follows:

Fig

no.2.2: Growth rate of commercial bank in Nepal

The above figure clearly

explains the growth rate of the commercial bank in Nepal. With the increase in

no of the commercial bank, the competition among the firm is also increasing

year by year.

CHAPTER

THREE

INTRODUCTION

OF THE ORGANIZATION

3.1

Background

Civil Bank Limited (CiBL)

has established itself as the 30th commercial bank of Nepal. It is founded by

promoters with the strong background in real estate, financial institutions,

business, trade, and industry. The Bank envisions in becoming a dominant player

in the Nepalese banking industry.

The Bank has been

registered with an issued capital of NRs. 2000 million and paid up capital of

NRs. 1200 million. The Bank firmly believes in contributing to the nation's

economic growth by rendering services and empowerment to all classes and

sectors of the society. Recently this bank has been running with its 13

branches located at different parts of Nepal.

3.1.1

Vision of CiBL

To become the most

trusted bank by providing dedicated service and support to customers through

thick or thin.

3.1.2

Mission of CiBL

To become every Nepali's

banking partner by extending all types of banking services.

3.1.3

Goal of CiBL

To contribute

directly/indirectly in the economic growth of the country by being a prominent

player associated with all classes and sectors of society.

3.1.4

Objectives of CiBL

• Prudent expansion

• Innovation

• Dedicated customer service

• Competitive human resource

• Vigilance

With the two major

slogans, one bank 20 million aspirations and thinking forward moving forward,

CiBL has been moving forward to make its own different and renowned status in

the banking industry.

Similarly, the bank bases

itself on a set of superior values and moral principles. It aims to succeed and

reach higher grounds by maintaining and adhering to its corporate values.

The corporate values

governing Civil Bank's development include:

• Maintain the highest standards in all

relationships with customers, suppliers, environment and community.

• Foster a climate which encourages

innovation and diligence amongst staff and reward accordingly.

• Function with the principle of

"Thinking Forward Moving Forward".

3.1.5

Board of Directors (B.O.D)

The Board of directors of

CiBL consists of five members who have been elected for the proper execution of

banking activities and services. The board of director of Civil Bank consists

of promoters of Civil Bank. The name and designation of B.O.D are presented in

the annex.

3.1.6

Management Committee

Management committee of

CiBL consists of 20 people with their respective field of management is

presented in the annex.

3.1.7

Branch network

Civil Bank Ltd is trying

to reach maximum numbers customer by establishing new well-equipped branches in

different areas of Nepal. The Head Office of CiBL is located at Kamaladi,

Classic Complex, Kathmandu.

It has 13 branches all

over the country, 4 branches inside valley and 9 branches outside the valley.

The details about the branches are listed in the annex.

3.1.8 Equity structure of

CiBL

The CiBL is founded by

the promoters with the strong economic background. The bank has not issued its

share to the general public yet, but it has decided to issue the share to the

public amounting Rs. 80 million in the month of Mangshir. The current detail of

the equity of the firm is as follows:

Table

no.3.1: Equity Structure of CiBL

S

N

|

Equity

|

Amount

|

1.

|

Authorized capital

|

Rs.

4 billion

|

2.

|

Issued

capital

|

Rs.

2 billion

|

3.

|

Paid

up capital

|

Rs.

1200 million

|

The above table can be

presented in diagram as follows:

Fig

no.3.1: Equity structure of CiBL

3.1.9

Major indicators of CiBL

Table

no.3.2: major indicators of CiBL

Types of indicators

|

Relative rating

|

Earnings

per share

|

Rs. 0.10

|

Market

price per share

|

N/A

|

PE ratio

|

N/A

|

CRR

(Liquidity ratio)

|

24.25%

|

Weighted

average interest rate spread

|

2.5%

|

3.2

Product and services

3.2.1 Deposits

3.2.1.1

Saving accounts

1. Mero

Bachat Khata

Civil Bank Mero Bachat

Khata is an interest bearing normal savings account. This account intends to

develop a saving habit for the future in order to facilitate the accumulation

of funds over a period of time.

Criteria:

Minimum Balance: (No

minimum balance required)

Rate of Interest: 6.50%

per annum (On Daily Balance)

Withdrawals and Deposits:

Unrestricted

2.

Aama Buwa Bachat Khata

Civil Bank Ama Buwa

Bachat Khata is a special savings product designed for senior citizens. This

product not just yields high returns on the hard-earned income but also

provides them with convenience and easy accessibility to their savings account.

Criteria:

Minimum Balance: NPR

10,000

Rate of Interest: 7.75%

per annum (On Daily Balance)

Withdrawals and Deposits:

Unrestricted

Interest Posting: Monthly

Qualifying Age: 58 and

above

3.

Kishore Bachat Khata

Civil Bank Kishor Bachat

Khata is designed to instill a savings habit amongst parents so that can save

and amass the significant amount of funds to build a secure future for their

children.

Criteria:

Minimum Balance: NPR

1,000

Rate of Interest: 7% per

annum (On Daily Balance)

Withdrawals and Deposits:

Unrestricted

Qualifying Age: 16 and

below

4.

Nari Bachat Khata

Civil Bank Nari Bachat

Khata is a product especially for the ladies (housewives, professionals, and

others). This product is tailor-made to suit the requirements of its target

audience. This savings account offers exclusive value-added services.

Criteria:

Minimum Balance: NPR

1,000

Rate of Interest: 7% per

annum (On Daily Balance)

Withdrawals and Deposits:

Unrestricted

Qualifying Gender:

Females

5.

Gold Savings Account

Civil Bank Gold Savings

Account is savings scheme which offers an attractive rate of interest and is

for those individuals who are self-employed or professionals working in various

organizations. This scheme also gives the accountholder the added flexibility

of unrestricted withdrawal.

Criteria:

Minimum Balance: NPR 50,000

Rate of Interest: 8.50%

per annum (On Daily Balance)

Withdrawals and Deposits:

Unrestricted

6.

Silver Savings Account

Civil Bank Silver Savings

Account is savings scheme which offers a competitive rate of interest to the

accountholder and is for those individuals who are self-employed or

professionals working in various organizations. Besides offering an attractive

interest rate, the product is also flexible in that the customer can withdraw

and deposit funds as per their convenience while retaining the required minimum

balance in the account.

Criteria:

Minimum Balance: NPR

10,000

Rate of Interest: 7.50%

per annum (On Daily Balance)

Withdrawals and Deposits:

Unrestricted

7.

Civil Bank Loyalty Call Account

Civil Bank Loyalty Call

Account is meant for individuals and corporate houses who seek to earn interest

on their deposits on a daily balance as well as experience the flexibility which

the market today demands. Accountholders are paid interest on the daily balance

in their call account.

Criteria:

Minimum Balance: NPR

1,000,000

Withdrawals and Deposits:

Unrestricted

Account Type: - Loyalty

Current Account

Loyalty Call Account

Interest Rate

Calculation: Daily Basis

3.2.2

Loans and Advances

1. Personal Mortgage Loan

Civil Bank Personal

Mortgage Loan is one such product to cater to the various financing requirement

of individuals.

2. Home Loan

Civil Bank Home Loan is

established as a retail lending product to cater to the prevailing market

demands. CiBL 'Home Loan' limit shall be fixed for minimum and maximum range of

NPR 100,000 and NPR 50,000,000 respectively for all types of schemes.

3. Hire Purchase Loan

Civil Bank Hire Purchase

Loan (CiHPL) as a retail lending product to cater to the prevailing market

demands. Hire Purchase Loan will be applicable to private automobiles (cars,

jeeps), commercial vehicles (trucks, buses), heavy equipment (excavators,

cranes, dozers) and other equipment (hospital equipment, heavy kitchen

equipment).

4. Loan against Fixed Deposit Receipt

The Loan against Fixed

Deposit is an added feature in the Fixed Deposit product and enables the

depositor/accountholder to withdraw a certain percentage of the deposit as a

loan to cater his/her various immediate needs.

5. Loan against Government Bond/ Securities

Loan against Government

Bond/Securities enables an individual or firm to avail a loan against the value

of the securities and bonds in their possession.

3.3

PORTER’S Analysis of CiBL

Porter’s approach

contends that an organization is most concerned with the intensity of

competition within its industry. The level of this intensity is determined by

five basic competitive forces. An organization must carefully scan the task

environment to assess the importance to its success of each:

Fig

no.3.2: Porter’s Analysis

• Threat

of New Entrant

The new entrants enter

the market with new ideas and innovation. This may become threat to the new

entrants. Threat to CiBL is very high due to the following reasons given in the

next page:

o It is newly established bank

o Lower no of branches with comparison to

others

o Market share is relatively low

• Rivalry among existing firms

The competition among the

existing firms is increasing day by day. Any competitive move by one firm may

have noticeable effect on its competitors and thus may cause retaliation or

countermove. The existing banks in the industry are itself the major competitor

of the CiBL.

• Threat

of substitute products and services:

Substitute products are

those products that appear to be different but can satisfy the same need as

another product. CiBL provides the wide

range of products and services that has been able to satisfy the customers.

• Bargaining power of Buyers:

Buyers affect an industry

through their ability to force down price, bargain for higher quality or more

services. CiBL has been able to satisfy most of the need of customers by

providing the qualitative products and convenience services.

• Bargaining

Power of Suppliers:

Depositors and creditors

are considered as its actual supplier in the commercial bank because deposits

and the credits are the basic raw materials. The bargaining power of the

customers is low in the banking industries because the customers cannot bargain

over the interest rate provided on deposit. The interest rate on deposit is

comparatively higher at CiBL that is why customers prefer to keep their deposit

in this bank.

3.4

Major Competitors

In today’s economy, the

banking sector is leading sector for the economic growth and prosperity. So,

the competition in the banking sector is getting tougher. CiBL is the newly

established bank hence the existing banks of the industry are itself its

competitor. The top competitor of the industry can be shown in the following

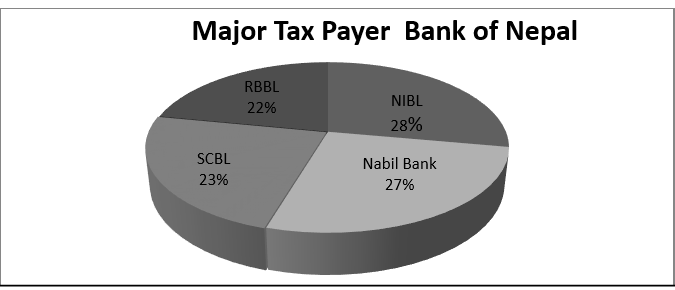

chart with respect to their tax payment as follows:

Fig

no.3.3: Major Tax Payers Bank of Nepal

The above data also

determines the competitive position of the organization within the industry.

The bank that pays the highest tax shows they are earning the higher profit.

CIBL is the newly established bank and should compete with each and every

existing bank for its market share, customers and also for the overall

profitability of the bank itself.

3.5 SWOT Analysis of CiBL

The SWOT analysis of the

CiBL can be explained with the figure as follows:

Fig

no.3.4: SWOT analysis of CiBL

CHAPTER

FOUR

ANALYSIS

OF ACTIVITES DONE AND PROBLEMS SOLVED

4.1

Analysis of Activities Performed

During the internship

period, interne have been assigned in Credit Department of the bank for two

weeks to get familiar with credit lending process, and documents required for

the credit allocation to the customers. Credit Department mainly looks after

the various documents required while processing loan makes necessary legal

documents on behalf of the bank and analyze the various risks engaged with the

loan and functioned for the mitigation of such default in the loan. In

remaining six weeks of the internship period, interne was assigned for CSD,

Marketing, and Letter of the Credit department.

4.2

Introduction to Credit Department

Credit Departments within

banks have become increasingly complex driven by the demands of regulation and

the business. The level of sophistication has accelerated in recent years as

many banks have developed credit departments with enhanced responsibilities.

The Credit Department is an independent risk oversight function. It is charged

with managing and overseeing the counterparty credit risk profile of the

Institutional Securities Business. The Credit Department’s specific

responsibilities include evaluating and rating the credit risk of counterparties,

establishing and managing counterparty credit risk limits, evaluating credit

risk transactions and approving, rejecting or modifying them as appropriate.

4.2.1

Functions of Credit Department

Some of the major

functions of the credit and loan department observed during the internship

period are as follows:

• Establishing the relationship with the

customers and informing them about the various credit instruments available as

per their requirement along with the terms and conditions.

• Analyzing the credibility of the customers

by assessing:

o Capacity of the customer for repayment of

the loan

o Collateral being put forward by customer,

whether or not, enough to meet the credit facility to be approved

o Character of the customer to recover the

loan provided

o Condition of the customer(background)

o Capital invested by the corporate

client

o Financial health of the corporation of

corporate client

o Reliable sources of individual customers to

make repayment of credit

4.3

Process of Disbursement of Loan

Banks do not provide loan

spontaneously. They undergo certain

processes in the course of granting the loan. The process of granting loan in

CiBL is as follows:

Fig

no.3.3: Process of disbursement of loan in CiBL

When the customer comes

to the Relationship manager for loan in the bank, the RM makes a proposal and

forwards it to the credit unit for approval. After the proposal is approved by

the credit unit, there is active participation of the Credit Risk Control

(CRC)/Credit Documentation Unit (CDU) for documentation, lodgment and limit

loading in the system. All the documents related to the loan are presented to

the CEO for final approval before loading the limit in the system after which

limit is loaded and the credit department releases the loan to the customers.

4.4 Types of Loan

A. Funded

In funded facilities,

there is the direct outflow of cash from the bank to the according to his/her

requirement. Bank can offer a wide variety of funded facilities depending upon

the nature of requirement.

B. Non-Funded

In non-funded facilities,

bank act as a liable holder. Bank doesn’t have to offer any cash to the client

but in the case of default by the client, the bank has to be completely liable

for the damages and cost for the third party. Thus, in the majority of non-funded

facilities, bank act as guarantor.

4.4.1

Types of Loan offered by CiBL

A. Civil Bank Personal Mortgage Loan

Basic

Eligibility Criteria:

Individuals or group of

individuals requesting for CiPML must be able to justify the following:

• The reliable and steady source of income to

serve the loan installment amount along with interest.

• Declare the purpose of the loan.

• Provide unencumbered fixed assets

collateral (land and building) fully covering the requested loan exposure.

Types of CiPML

Two types of CiPML shall

be provided depending upon the nature of the funding requirement:

• NonRevolving (CiPML I)

• Revolving (CiPML II)

Loan

Limit

• The minimum limit of CiPML is NPR. 100,000.

• The maximum limit of CiPML is NPR. 50,000,000.

Loan

Tenure

• The loan tenure of CiPML shall be fixed on

the basis of loan repayment capacity of the borrower.

• The loan tenure for CiPML (NonRevolving)

shall be fixed for the maximum of 8 years or less.

• The loan tenure for CiPML (Revolving) in

the form of overdraft shall be for maximum period of 1 year and can be renewed

on an annual basis.

Interest

Rate

The interest rate on

CiPML will be decided by the competent authority from time to time.

B. Civil Bank Home Loan

It is established as a

retail lending product to cater to the prevailing market demands.

Basic

Eligibility Criteria

Any Nepalese individual

of at least 18 years of age is eligible for Home Loan facility subject to

stable, reliable source of income. Furthermore, the disposable income should be

sufficient to serve the loan installment and due interest.

Types

of Civil Bank Home Loan Schemes

• Civil Bank Home Loan Purchase Scheme

(CiHL1)

• Civil Bank Home Loan Construction Scheme

• Civil 'Home Loan' Renovation Scheme

Loan

Limit

Civil Bank 'Home Loan'

limit shall be fixed for minimum and maximum range of NPR 100,000 and NPR

50,000,000 respectively for all types of schemes.

Loan

Tenure

The tenure of the loan

shall be for a minimum period of 5 years and the maximum period of 25 years.

This will be inclusive of the construction period and the grace period, if any.

Interest

Rate

The interest rates on the

Home Loan shall be determined by the competent authority as per the tenure of the

loan. The base rate will be the rate of interest on the Home Loan for 5 years.

The rate of interest may,

however, be revised from time to time as decided by the management.

C. Civil Bank Hire Purchase Loan

During the last decade of

banking, retail lending has established itself as one of the profitable sectors

in the banking industry. Civil Bank has therefore decided to develop and

introduce Civil Bank Hire Purchase Loan (CiHPL) as a retail lending product to

cater to the prevailing market demands. Hire Purchase Loan will be applicable

to private automobiles (cars, jeeps), commercial vehicles (trucks, buses),

heavy equipment (excavators, cranes, dozers) and other equipment (hospital

equipment, heavy kitchen equipment).

Basic

Eligibility Criteria

Any Nepalese individual

of at least 18 years of age or any company is eligible for a Civil Bank Hire

Purchase Loan facility subject to a stable, reliable source of income. The

disposable income should be sufficient to serve the loan installment and due

interest.

A company can also apply

for a CiHPL if the requirement is well justified.

Types

of CiHPL

• Civil Bank Hire Purchase Loan for Private

Vehicles (CiHPL1)

• Civil 'Hire Purchase Loan' for Commercial

Vehicles (CiHPL2)

• Civil 'Hire Purchase Loan' Heavy Equipment

Scheme (CiHPL3)

• Civil 'Hire Purchase Loan' Other

Equipment/Machines Scheme(CiHPL4)

Loan

Limit

Civil Bank 'Hire Purchase

Loan' limit will be fixed for a minimum and maximum range of NPR 500,000 and

50,000,000 respectively for all types of schemes.

Loan

Tenure

• For Scheme I and II: The tenure of the loan

shall be for a maximum period of 8 years.

• For Scheme III and IV: The tenure of the

loan shall be for a maximum period of 10 years.

Interest

Rate

The interest rates on the

Civil Bank Hire Purchase Loan will be determined by the competent authority as

per the tenure of the loan.

D. Civil Bank Loan against Fixed Deposit

Receipt

The Loan against Fixed

Deposit is an added feature in the Fixed Deposit product and enables the

depositor/accountholder to withdraw a certain percentage of the deposit amount

as a loan to cater to his/her various immediate needs.

Loan

Limit

Normally, the Bank will

finance up to 90% of the value of the FD, if the same is issued by itself. In

the case of loan against FDR issued by other Banks/financial institutions, the

Bank may not finance more than 80% of the face value. However, in exceptional

cases, the credit may be extended up to the face value of the instrument upon

approval from the competent authority. In case issuance of a performance

guarantee, the credit can be extended up to the face value of the instrument.

The rate of interest on loan against FDR should not be lower than the coupon

rate of the FD.

In case the currency of

denomination of FDR and the currency of loan is different, the Bank will not

generally finance more than 80% of the face value of the instrument. In case

the financing is more than 80%, it needs to be reviewed on the monthly basis to

guard against the foreign exchange fluctuation risk.

Loan

Tenure

The loan shall be for a

maximum tenure of 1-year renewable periodically up to the expiry date of FDR

held as security. It should be ensured that loan maturity date is prior to

Fixed Deposit Maturity date.

Interest

Rate

The interest rate on

'Loan against FDR' will be decided by the competent authority from time to

time.

E. Civil Bank Loan against Government

Bond/Securities

Loan against Government

Bond/Securities enables an individual or firm to avail a loan against the value

of the securities and bonds in their possession.

Loan Limit

Generally, Credit against

Govt. / NRB Instrument will be extended up to 90% of the value of the instrument.

However, in exceptional cases, the credit may be extended up to the face value

of the instrument upon approval from a competent authority.

Loan

Tenure

The tenure of the loan

shall be for a period of one year.

Interest

Rate

The interest rate on 'Loan

against GB' will be decided by the competent authority from time to time.

Civil Loan against Shares

(CiLS) is a product designed to cater to the various financing requirements of

various types of individual and investment firms.

Basic

Eligibility Criteria

Lending in Shares has

been highly regulated by the NRB. As such there are various requirements to be

met by the Bank as well as the Borrowers.

• A company whose share will be pledged to

the Bank must be listed in the NEPSE.

• Limits will be subjected to a maximum of

60% of the average of the last 180 days, closing price or latest closing price,

whichever is lower.

• The primary capital/net worth of the

company whose shares are proposed as security should be in the positive.

• If the proposed shares are of

banks/financial institutions, CAR of the same must be within the norms set by

NRB. Also, the auditing of the bank/financial institution should have been made

as required by the NRB directives.

• CiBL's total exposure on margin lending, including

the proposed lending, should exceed its core capital.

• Total exposure against the shares of a

specified listed company should not exceed 25% of the core capital of the Bank.

• Original share certificates should be

deposited to the Bank.

• Loan against shares should not be provided

for renewal/restructuring/rescheduling of an existing limit.

• The borrower/guarantor or their family

member should not be a director/CEO/Auditor/Secretary involved in the

management or accounting of the company whose shares have been proposed to

pledge for the loan.

• The loan limit will be assigned for a period

of one year on terminating basis. It will be nonrenewable.

• Applicant should have adequate sources of

income to service the debt and meet the margin call requirements as and when

required.

• CiLS will be revolving in nature and shall

be booked of overdraft facility in nature.

Loan

Limit

• The minimum limit of CiLS is NPR

100,000.00.

• The maximum limit of CiLS is NPR

50,000,000.

Loan

Tenure

The loan tenure for CiLS

(Revolving) in the form of an overdraft shall be for maximum period of 1 year.

This facility cannot be renewed on maturity and the loan has to be settled on

maturity. However, interest will be paid on a quarterly basis.

Interest

Rate

The interest rate on CiLS

will be decided by the competent authority from time to time.

4.5

Introduction of Credit risk

Credit risk arises

whenever a lender is exposed to loss from a borrower, obligor, or counterparty

who fails to honor their contracted debt obligation, as agreed, in a timely

manner. For lenders who extend credit in the form of loans or capital market

products, credit risk is inherent in all their business activities and is an

element in virtually every product and service that is provided.

In general, there are also degrees of

differences in the types of risks that credit transactions may hold, all of

which need to be specifically understood by the credit organization relative to

how they will impact the credit portfolio. Managing the risks that are

contained in providing debt services requires a systematic framework to be established

throughout the relevant credit areas; this is known as the credit process.

4.6

Legal Documents required for loan disbursement

• Copy of ‘Lal Purja’

• Land tax receipt

• Char Killa from ward office

• Approved map/certificate of building from

municipality or VDC

• Citizenship certificate of the owners of

the property

• Registration certificate of company(in case

the customer is a company)

• Income tax registration of company

• Copy of minimum government rate of land

4.7

Problems Solved

Credit Department is the

heart of any bank. Credit Department of any bank is responsible for the income

and profitability of the firm. The difference on the interest rate on deposits

and interest rate on loans is the income of the bank and this is called,

“interest rate spread”. After involving in the credit department of CiBL as an

intern, interne assisted the credit department head for performing different

tasks which were left pending. Internee’s assistance helped the staffs in

presenting the files and reports to the auditors quite quickly. Calculation of

various ratios of firm balance sheet and income statement takes a lot of time

for the staffs and interne helped the staff by calculating these ratios. The

followings are the major problems solved by the interne in the credit

department:

• Calculation of various ratios of B/S of

applicant’s firm

• Preparation of location maps

• Stock visit and report preparation

• Prepare checklist of documents presented by

the applicants

• Tallying the documents issued and fill up

in application form

• Operation of various machinery e.g.

photocopy, printer, fax etc

CHAPTER

FIVE

CONCLUSION

AND LESSON LEARNT

5.1

Conclusion

The internship program is

the way of implementing theoretical knowledge in real life (job place). The

internship is an academic curriculum based on practical work experience in a

particular field of study that enhances student learning. It provides great

strength for the student’s future career. Internship program not only provides

an opportunity to get exposure to the real working environment but also helps

to develop interpersonal skills and gaining knowledge on different aspects of

finance, accounting and other topics in an official setting.

Despite instability and

ongoing problems in the country, the banking sector is prospering with not many

difficulties and, therefore, gaining a major strength in the economy. CiBL,

being a new bank in the industry, is expanding its branches and services all

over the country to become the leading bank of the industry.

Interne had a great

experience working in CiBL. Especially working in Credit Department, it helps

to realize internee’s own competencies and level of understanding regarding

Banking Sector of Nepal and their proper management. This internship program

helps a lot for understanding, analyzing and interpreting about the banking

industry in Nepal as well as the function and role of the commercial bank in

our country.

5.2 Lesson Learnt

Theoretical knowledge is

vastly different than practical experiences. Working in real life situation

practically is not as simple as we think of. It requires high dedication,

commitment, and discipline. An opportunity to learn and do new things

practically in the work place at CiBL was a great experience. In fact, CiBL

helped to build knowledge horizon as to how Nepalese Financial System actually

functioned. Ability to look upon the problems carefully, skills to get

acquainted with co-workers, performing and completion of the job at the pre-determined

time, punctuality, handling of work flows effectively, coordination of activities, etc are the general things learnt

during the eight weeks of internship.

Besides, there is various

other experiences and knowledge acquisition in CiBL which are pointed out as:

• The most important lesson learnt during the

stay at CiBL was about the day to day operation of different departments and

the process involved with it

• Coordination of workforce and the various

activities for smooth operation of the bank

• Importance of time management and

punctuality

• Promotion of efficiency and effectiveness

through sincerity and confidence

• It helped to familiarize the gap between

theoretical knowledge and real life situation

• Devotion in work and sacrifices of personal

matters during office time

• Learnt to use and operate various

machinery, equipment, and systems

• Self-confidence and companionship

• Learnt to work in pressure

• Learnt to develop the interpersonal

relationship.

EmoticonEmoticon