Internship Report on Himalayan Bank Limited

CHAPTER ONE

INTRODUCTION

1.1 Background of Study

Bachelor in

Business Administration (BBA) program is run by Tribhuvan University from 2002

under the supervision of the Faculty of Management (FOM). It aims to provide

quality education through quality and professional courses. BBA is four years

international standard program consisting of eight semesters along with

internship program. Thus, BBA program is a blend of theoretical and practical

knowledge on the financial sector enabling the students in understanding

business environment and solving practical business problems. It also aims to

develop creative, socially responsible and skilled professionals who are able

to carry out the responsibility of middle level managerial positions in the

rapidly growing business sector in Nepal as well as abroad.

Theoretical

knowledge is not sufficient in this competitive and complex business world.

Thus, in the eight semester of BBA program, student is required

to work in financial institution for at-least eight weeks, where they can

experience real situations of work environment in the organization. It also

helps in understanding organizational environment and work culture. Internship

program enables in acquiring skills and techniques by experiencing practical work situations

directly applicable to develop career on financial sectors. It may also create

the opportunities for placements in the same host organization or other

organizations.

1.2 Objective of Report

After the

completion of internship program, it is required to prepare the report to be

acquainted with what the student have learnt in the host organization over the

internship period. It helps to share the experience of student along with

problem faced by them. The main objective of the study is to highlight the

activities carried out in Himalayan Bank Limited, Thamel Branch and to get the

practical exposure to the organization’s environment and gaining the practical

knowledge to deal with the real management problems through various managerial

skills. The specific objectives of this study are:

·

To

provide a brief synopsis on the present scenario of Nepalese banking sector.

·

To

enlighten the task performed in HBL under various departments.

·

To

comprehend the operational system of HBL.

·

To

give details of the product and services provided by the HBL.

·

To

build self-confidence and experience in the work environment.

1.3 Methodology

This

internship report is based on research methodology. It helped to analyze the

data in finding the cause and effect relationship to see how bank is

performing. Since, research is a scientific discipline; it needs much more

attention on the part of the researcher.

1.3.1 Organization Selection

Decision

about the organization selection for the internship program is very crucial

task due to existence of different financial institutions in the Nepalese

financial market. Internship from a reputed organization definitely enlarges

the prospects of gaining more practical knowledge and also enhances confidence

of every student. Since I did

specialization on Banking and Finance I selected to do internship in the

Banking institution to boost my knowledge. As commercial banks are 'A' class

financial institutions I chose them among other financial institutions. I

dropped the college recommendation letter and personal application with resume

in Himalayan Bank Ltd. since it is one of the reputed banking institutions with

great operations. Further, I did regular follow–up with the human resource

department of HBL. After screening my

resume by the Human Resource Department of HBL I was selected for internship placement.

1.3.2 Placement

As concern

to my placement in HBL, throughout my internship period I was placed in Thamel

branch. There I got an opportunity to work in different department such as

bills and remittance department, customer service department, trade finance,

customer relation department, credit management and administration department.

The task was assigned as per the requirement of the different department under

the supervision of respective department head. I was fortunate enough to gain

knowledge on various departments under proper supervision of department heads

and staffs during the internship period. I presented myself with full

confidence and well-disciplined in this institution and created mutual trust

among the staffs and got the opportunity to learn functioning of different

departments.

1.3.3 Duration of Internship

The duration

of internship period has been declared for minimum 8 weeks by FOM, Tribhuvan

University. During eighth semester, student should complete internship acquire

six credit hours. As per the requirement, the internship was carried out from

June 15, 2012 to August 13, 2012 in

HBL, Thamel branch from 10:00 am and to 5:00 pm

in different departments. In this period I was placed in various departments so

that I could develop knowledge about various activities performed in each

department making me able to achieve practical; disclosure to functioning

process.

Table 1.1 Duration of

Internship

|

Departments/

Weeks

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

|

Bills and Remittance

|

|

|

|

|

|

|

|

|

|

Customer Service

|

|

|

|

|

|

|

|

|

|

Letter of Credit

|

|

|

|

|

|

|

|

|

|

Customer Relation

|

|

|

|

|

|

|

|

|

|

Credit management and administration

|

|

|

|

|

|

|

|

|

1.3.4 Information Collection Methods

The primary

as well as secondary information has been used to prepare this report.

Ø

Primary Sources

a.

Observation

during internship in HBL

b.

Questionnaire

with employees and customers of HBL

c.

Files,

registers, computer data

Ø Secondary

Sources

a. Internet Surfing

b.

Reports

and Brochures

c.

Publications

and journals

1.4 Limitations of the Study

Every activity is chase by the

boundaries and limitations. So, the same tendency happens while preparing this

internship report. Some constraints faced during preparing this report are

listed below:

·

This study is mainly concentrated on

activities done during internship period.

·

Due to limited time, the study has been

conducted quickly.

·

Less interaction and guidance by the staffs

to the intern due to their own rush.

·

As internship period was during closing of

the fiscal year i.e. Ashad, bank's staffs have excess workload due to which

they cannot supervise the intern properly.

·

Because of rush, interns were confined to

routine job of the bank and was not able to acquire crucial information of the

bank.

·

Being a student, lack of technical knowledge

was another factor which limits the report.

·

This report is based on my individual

experience, ideas and skills achieved during the internship period rather than

theoretical knowledge.

·

The details of prescribed departments and its

transaction were not provided to intern due to confidentiality reasons and

policies of the bank.

CHAPTER TWO

INTRODUCTION OF THE INDUSTRY

2.1 Introduction of Bank

After commerce and the arts

had revived in Italy, the business of banking was resumed.

The word "bank" is commonly regarded as derived from the Italian word

'Banco', a bench - the Jews in Lombardy having benches in the market-place for

the exchange of money and

bills. And people around the world start to use different words for their

convenient like in French 'Banque', Latin 'Bancus', and German 'Bank'. At

ancient times, bank means moneylenders who sat in the bench for keeping,

lending and exchanging of money in the market place.

A bank is an

institution which deals in money receiving as deposits from customers, honoring

customers drawing against such deposits on demand, collecting cheques for

customers and lending or investing surplus deposits until they are requires for

repayment. It allows interest on the deposits made and charges

interest on the loans granted and further it creates credit and supports for

the formation of capital and hence it is regarded as manufacturer of money.

In simple, bank is an institution which deals with money and

credit. A bank is a financial institution that serves as a financial

intermediary, who bridges

gap between the savers of the fund and users of the funds. Nowadays, a bank has

broadened its scope by providing financial as well as non-financial services to

its customers. To give specific meaning of bank is very difficult task however

following are the few definitions given by different authors.

"Banking means the accepting for the purpose of lending or investment of

deposits of money from the public, repayable on demand or otherwise and

withdrawal by cheque draft order or otherwise." --Indian Banking

Company Act 1949

"Bank is an organization established

for the purpose of exchange money deposit lending money and participation in

transactions." --Commercial Bank Act of 2031

"Bank is a financial institution, which

provides financial services that may be in the form of accepting deposits,

advancing loan, providing necessary technical advices, dealing overt foreign

currencies, remitting funds, etc." –Nepal Rastra Bank Act 2002

From the

above definitions, we draw the conclusion that a bank is a financial

intermediary that accepts deposits and channels those deposits into lending

activities, either directly or through capital markets. It is the most

important financial institution dealing with money, receiving it as deposits

from customers, honoring customers drawing against such deposits on demand,

collecting cheques for customers and lending or investing surplus deposits

until they are required for repayment.

Thus, bank

receives demand deposits and time deposits, honors instruments drawn on them,

and pays interest on them, makes loans, and invests in securities, collects

cheques, drafts and certifies depositor's cheques and issues drafts and

cashier's cheques. The difference in interest rate on lending and deposit,

interest rate spread, is the major source of income for the bank. Interest on

lending is higher than the deposits.

2.2 History of Banking in Global Scenario

The history

of banking is nearly as old as civilization. In the Babylon, at the time of Hammurabi,

in the 18th century BC, there are records of loans made by the priests of the

temple. The concept of banking has arrived. When the word bank is used

it is meant for commercial bank. Before 1960 there was no such word as

“banking’. However, in the temple Babylon the practices of safeguarding and

saving flourished as early as 2000 B.C. Chanakya in his Arthashastra written in

about 300 B.C. mentioning about the existence of powerful guilds of merchant’s

bankers received deposits, advance loans and hundies. Merchants and goldsmith

were ancestors of bank.

The 'Bank of

Venice', established in1157 A.D. is supposed to be the ancient bank.

Originally, it was not a bank in real sense being simply on office for the

transfer of the public debt. Venice, after being possibly the first city to

found a bank for the keeping of money on safe deposit and the clearing of

cheques, is also a pioneer in the involvement of a bank with state financiers.

In 1617 the BancoGiro is established to solve problems encountered by the

earlier, which has got into trouble through the making of unsecured loans. Subsequently, 'Bank

of Barcelona' (1401) and 'Bank of Geneva' (1407) were established.

During the

18th century the Bank of England gradually undertakes many of the tasks now

associated with a central bank, The 'Bank of England', first English Bank, was

established in1964 A.D. It organizes the

sale of government bonds when funds need to be raised. It acts as a clearing

bank for government departments, facilitating and processing their daily

transactions.

History

apart, it was the “Merchant bank” that first evolved the system by trading in

commodities than money. They used to do their trading activities by remitting

the money from one place to another. The next stage in the growth of banking

was goldsmith. An honest goldsmith was also trusted with billions money and

ornaments by merchants in neighborhoods. He started charging for acting as

custodians of these valuables. As an evidence for receiving valuables he issued

a receipt, which in turn became like cheques as a mode of exchange. He started

advancing the coins on loan by charging interest. He started to keep some

reserve as a safeguard. In this way the goldsmith money lender became a banker

who started performing the two functions of modern banking that of accepting

deposits and advancing loans.

2.3 History of Banking in Nepal

Banking service is the oldest service industry in Nepal. It

has gone through various stages of evolution and development since the Vedic

times (2000 to 1400 B.C.). In the Nepalese chronicles, it was recorded that the

new era known as Nepal Sambat was introduced by Shankhadhar, a Sudra merchant

of Kantipur in 880 A.D.

The banking in the form of money leading can be traced back in

the reign of Gun Kam Dev towards the end of 8th century. According to the

historical evidence in 723 Gun Kam Dev, the king of Kathmandu had borrowed

money to rebuild and to rule Kathmandu.

In the 11th century, during Malla regime, there was an evidence

of professional money-lenders and bankers. It is further believed that

money-lending business, particularly for financing the foreign trade with

Tibet, became quite popular.

Another historical example as to the pre-modern banking

system is found when Rana Prime minister Randip Singh was administering Nepal

in 1880 A.D. During his regime one financial institution name by

"TejarathAdda" was establish to give loan facilities to the

governmental staff and to afford loan facilities to the public in general in

the term of 5% interest. The credit facilities of "TejarathAdda" were

also extended outside the valley during the Prime Minister ship of Chandra

Shumsher Rana. Although this institution did not accept any deposits, it had

played an important role in the development process of banking system in Nepal.

Modern banking business started in the country just before the Second World

War. In 1938 state financial institute which supply credit or loan against

security.

His Majesty

King Tribhuvan inaugurated first commercial bank i.e. Nepal Bank Limited on

Kartik 30, 1994 B.S. In the year 1994 B.S. as a semi government organization

with an authorized capital RS.10 million of which 51% share are owned by

government, this marked the beginning of an era of formal banking in Nepal.

Until then all monetary tractions were carried out by private dealers and

trading center.

The need to

regulate financial and monetary system increased enormously resulting in the

establishment of Nepal Rastra Bank in 2013 B.S. In order to cater the demand of

banking system, Rastriya Banijya Bank was established in 2022 B.S with 100%

government ownership.

Later some

development banks and financial institutions were established to provide medium

and long-term credit facilities to the industry and agriculture. In this contest, Nepal Industrial Development

Corporation was established in 2016 B.S. to provide the financial and

managerial assistance in the field of industry and to help private sector in the

field of industry. In order to provide service to the agriculture sector,

Agriculture Development Bank Ltd. was established in 2024 B.S.

The

government of Nepal adopted liberal economic policy to accelerate country's

growth and development. Foreign investment and participation of private sector

were encouraged. The government then enacted "Joint Venture Banking"

policy. Commercial Banks should operate under the Commercial Bank Act 2031,

Nepal Rastra Bank Act 2058 and Contract Act 2056. Nepal Arab Bank Ltd.

(currently known as NABIL) is the first bank established in joint investment in

Nepal in 2041 B.S. With the passage of time several other joint venture and

private bank has been established such as Indosuez bank Limited (Nepal

investment bank) in 2042 B.S., Nepal Grindlays Bank (Standard Chartered bank)

2043 B.S., Himalayan Bank Limited in 2049 B.S. and so on.

2.4 Present Scenario of Nepalese Financial System

Financial

system is the set of financial institutions, financial market, and financial

instruments along with regulations and laws. Financial system facilitates

resources transfer and mobilizes savings to the productive sectors thereby

contributing to the economic development.

Commercial

Banks are the heart of our financial system. A commercial

bank (or business

bank) is a type of financial

institution and intermediary.

It is a bank that provides transactional,

savings, and money market accounts and that accepts time

deposits. They hold the deposits of millions of persons,

governments and business units. They

make funds, available through their lending and investing activities to

borrowers, individual business firms and government. Therefore the task of

commercial banks in an under developed countries is almost self-evident. Their

purpose is to provide a collecting point for savings of a relatively small

average amount from a large number if individual source so long as to utilize

savings safely and profitably.

Hence,

commercial bank is the financial institution authorized to receive both time

and demand deposits, to make loans of various types, to engage in trust

services, to issue letters of credit, to accept and pay drafts, to rent safety

deposit boxes, and to engage in similar activities and ventures.

Financial

institutions are the organization that channelizes the savings of government,

businesses and individual into loans and investment. It consists of:

·

Depository Institutions

Depository

institutions are the banking institutions which collect amount through deposits

accounts and sold bulk amount through loan account. In Nepal, NRB has

classified depository institutions as follows:

Table 2.1 List of no.

of depository institutions

|

Class

|

Financial Institutions

|

No. of Institutions

|

|

A

B

C

D

|

Commercial Bank

Development Bank

Finance Companies

Micro Credit Development Banks

|

32

88

70

24

|

Source: www.nrb.org.np

·

Non-depository Institutions

Non-depository

institutions are an intermediary who does not accept the deposit directly from

the customers. They are insurance companies, investment banks, pension funds,

etc.

2.5 Functions

of Commercial Banks

The

functions of commercial banks are divided into two categories:

I.

Primary Functions

The primary functions of a commercial

bank include:

|

A.

Acceptance of Deposits

v Currents deposits (demand

deposits)

v Savings deposits

v Fixed deposits

v Recurring deposit

v Miscellaneous deposits (Home

construction deposit scheme, Sickness benefit scheme, Children plan, Old age

pension scheme, etc)

|

B. Granting

loans and advances

v Loans (Credit facility for more

than 1 year)

i.

Demand

loan

ii.

Term

loan

v Advances (Short-term financial

assistance)

i.

Cash

Credit

ii.

Bank

Overdraft

iii.

Discounting

of Bill

|

II.

Secondary functions including

agency functions.

·

Issuing

letter of credit, travelers' cheques, circular notes etc.

·

Undertaking

safe custody of valuables, important documents, and securities by providing

safe deposit vaults or lockers.

·

Providing

customers with facilities of foreign exchange.

·

Transferring

money from one place to another and from one branch to another branch of the

bank.

·

Standing

guarantee on behalf of its customers, for making payments for purchase of

goods, machinery, vehicles etc.

·

Collecting

and supplying business information.

·

Issuing

demand drafts and pay orders and,

·

Providing

reports on the credit worthiness of customers.

2.6 Agency and General Utility Services provided by

Modern Commercial Banks

Besides

these two main activities, commercial banks also render a number of ancillary

services. These services supplement the main activities of the banks. They are

essentially non-banking in nature and broadly fall under two categories:

I) Agency Services

Agency

services are those services which are rendered by commercial banks as agents of

their customers. They include:

Ø

Collection

and payment of cheques and bills on behalf of the customers;

Ø

Collection

of dividends, interest and rent, etc. on behalf of customers, if instructed by

them.

Ø

Purchase

and sale of shares and securities on behalf of customers

Ø

Payment

of rent, interest, insurance premium, etc. on behalf of customers, if

instructed.

II) General utility services

General

utility services are those services which are rendered by commercial banks not

only to the customers but also to the general public. These are available to

the public on payment of a fee or charge.

They

include:

Ø

Issuing

letters of credit and travelers' cheques.

Ø

Underwriting

of shares, debentures, etc.

Ø

Safe-keeping

of valuables in safe deposit locker.

Ø

Supplying

trade information and statistical data useful to customers.

Ø

Undertaking

foreign exchange business.

2.7 Commercial Banks in Nepal

The year 1994

B.S. marks the beginning of new era, in the history of modern banking in Nepal.

Thus, we see the establishment of its first commercial bank i.e. Nepal Bank

Ltd. In the year 1994 B.S. as a semi government organization with an authorized

capital RS.10 million of which 51% share are owned by government within few

years of its establishment it extended a number of branches.

As the

time passed “Rastriya Banijya Bank” was established in 1966 A.D. in order to

play a major role not only in domestic banking services but also in foreign

trade. As the country followed economic liberalization, there was massive

entrance of foreign banks in Nepal. Nepal Indosuez Bank was established as a

joint venture between Nepal and France in 1986 A.D. Similarly, Nepal Grind lays

bank (Standard Chartered bank) was established in 2043 B.S. and Himalayan Bank

Ltd. was also established in 2049 B.S. with joint venture with Habib Bank Ltd.,

Pakistan.

Till 2068 there are many commercial banks as

well as development banks that have been working smoothly in Nepal. The

licensed commercial banks according to the central bank of Nepal i.e. NRB are

32 and they are listed in annex 1.

CHAPTER

THREE

INTRODUCTION OF THE ORGANIZATION

3.1 An Overview of Himalayan Bank Limited

Himalayan Bank was established in 1993 in joint venture with Habib

Bank Limited of Pakistan. Despite the cut-throat competition in the Nepalese

Banking sector, Himalayan Bank has been able to maintain a lead in the primary

banking activities- Loans and Deposits. It

goes with a punch line “The Power to Lead”.

Legacy of Himalayan lives on in an institution that's known

throughout Nepal for its innovative approaches to merchandising and customer

service. Products such as Premium Savings Account, HBL Proprietary Card and

Millionaire Deposit Scheme besides services such as ATMs and Tele-banking were

first introduced by HBL. Other financial institutions in the country have been

following our lead by introducing similar products and services. Therefore, HBL

stand for the innovations that bring about in this country to help customers

besides modernizing the banking sector. With the highest deposit base and loan

portfolio amongst private sector banks and extending guarantees to

correspondent banks covering exposure of other local banks under the credit standing with foreign correspondent

banks, HBL believe it as lead the banking sector of Nepal. The last year rating

of HBL by Bankers’ Almanac as country’s number 1 Bank easily confirms our

claim. Other awards

and recognitions received by the bank in the past 6 years also ranks the bank

in high positions with awards like:

· Best

Presented Account Award- 2008 awarded by The Institute of Chartered Accountants

of Nepal.

· Number

1 bank of Nepal-2006 awarded by the Bankers’ Almanac, Britain

· Number

1 bank of Nepal-2003 awarded by the Bankers’ Almanac, Britain

· National

Excellence Award- 2003 awarded by federation of Nepal chambers of Commerce and

Industry.

All Branches of HBL are integrated

into T-24, the single Banking software where the Bank has made substantial

investments. This has helped the Bank provide services like ‘Any Branch Banking

Facility’, Internet Banking and SMS Banking. Living up to the expectations and

aspirations of the customers and other stakeholders of being innovative, HBL

very recently introduced several new products and services. Millionaire Deposit

Scheme, Small Business Enterprises Loan, Pre-paid Visa Card, International

Travel Quota Credit Card, Consumer Finance through Credit Card and online

TOEFL, SAT, IELTS, etc. fee payment facility are some of the products and

services. HBL also has a dedicated offsite ‘Disaster Recovery Management

System’. Looking at the number of Nepalese workers abroad and their need for

formal money transfer channel; HBL has developed exclusive and proprietary

online money transfer software- Himal RemitTM. By deputing our own staff with

technical tie-ups with local exchange houses and banks, in the Middle East and

Gulf region, HBL is the biggest inward remittance handling bank in Nepal. All

this only reflects that HBL has an outside-in rather than inside-out approach

where customers’ needs and wants stand first.

HBL's VISION

To become a "Leading

Bank of the country" by

providing premium products and services to the customers, thus ensuring

attractive and substantial returns to the stakeholders of the bank.

HBL's MISSION

To become preferred provider of quality financial services

in the country. There are two components in the mission of the Bank; Preferred Provider and Quality

Financial Services; therefore HBL believe that the mission will be

accomplished only by satisfying these two important components with the

customer at focus. The bank always strives positioning itself in the hearts and

minds of the customers.

HBL’s Objective:

"To become the Bank of first

choice" is the main objective of the

Bank.

3.2 Equity Structure of HBL

The Equity structure of Himalayan Bank has been briefly summarized in the

table

below:

Table 3.1: Equity

structure of HBL

|

Equity

|

Amount (in Rs.)

|

|

Authorized Capital

|

2,400,000,000

|

|

Issued Capital

|

1,600,000,000

|

|

Paid up Capital

|

1,600,000,000

|

Source: HBL Annual

Report 2009/10

3.3

Share composition of HBL

The table below shows the share ownership of HBL.

Table 3.2: Share

ownership of HBL

|

Local Promoters

|

51%

|

|

Foreign Partners (Habib)

|

20%

|

|

Employee Provident Fund (EPF)

|

14%

|

|

General Public

|

15%

|

3.4 Organization Structure of HBL

Himalayan

Bank Limited has a very typical organization structure where the top level

management includes the CEO, Senior GM and GM. Under them are the various

departments of the bank with one person heading each department. The major

decisions are taken by chief Executive Committee. The organizational structure

of Himalayan bank is shown below:

3.5 Board of Directors in HBL

Himalayan

bank is managed by a team of professional Board of Directors. The Board of

Directors consists of the brilliant personalities assigned with various

designations. The name list of BODs along with their designations is placed in

annex 2.

3.6 Corporate Social Responsibilities by HBL

HBL is not only a bank; it is a committed corporate

citizen. Corporate Social Responsibility (CSR) holds one of the very important

aspects of HBL. Being one of the corporate citizens of the country, Right from the

time of its commencement, it has been discharging its social responsibilities

through various social and allied institutions. Being one of the active and

responsible corporate citizens of the country, HBL has always promoted social welfare

activities. Many activities that do a common good to the society have been

undertaken by HBL in the past. HBL is enthusiastically interested in enrolling

itself in such activities on an ongoing basis. The major services being

rendered by HBL in this front include those related to education, healthcare,

sports, culture and social services. HBL allocates a significant portion of its

‘Annual Sponsorship & Donation Budget’ for fulfilling social

responsibilities.

HBL CSR Activities:

- 2012: Financial Aid to

“PourakhiBalSikshyaKosh” to meet the education expenses of 10 children who

are barred from education.

- 2012: On the occasion of 19th

anniversary of Himalayan Bank, HimalRemit, under its corporate social

responsibility, distributed solar lanterns to local people of Salme VDC,

Nuwakot District, and the village which is yet to get connected to

national electricity distribution line.

- 2012: HimalRemit has

contributed to help Birendra Higher Secondary School, Pakuwa-6, Parbat

Dist. to rebuild its damaged building by a natural disaster. On the

occasion of 19th anniversary of Himalayan Bank, CEO Mr. Ashoke SJB Rana

handed over the contribution amount cheque to the principal of the school

Mr. Rudra Bahadur Rimal. The newly rebuilt building of the school was

inaugurated by General Manager of Himalayan Bank, Mr. Sushiel Joshi in a

ceremony held in the school premises on 21st June 2012.

- 2012: HimalRemit in

association with its principal agent CFS, distributed relief needs (rice

and lentil) to the appx 500 fire-victim families of Aurahi Village,

Siraha.

·

2012: HimalRemit provided Rs.

84,000 to the widow of deceased Dil Bahadur BK of Pipaltari-9, Parbat as a

small support to her daily needs. The amount will be availed in installments of

Rs 7,000 per month. Dil Bahadur BK, the only support to the family, was killed

in a road accident in Saudi Arabia.

3.7 Products and Services of HBL

A.

Deposit product

|

·

Fixed

deposits

·

Current

account

·

Normal

saving account

·

Bishesh

Saving Account

·

Recurring

saving account

·

Himal

saving account

|

·

Call

Account

·

Premium

saving account (PSA)

·

Super

premium saving account

·

Shareholder’s

saving account

·

Jumbo

Term deposits

·

Himal

remit saving account

|

B.

Loans

Loan facilities provided by HBL are:

1.

Corporate Loan

Corporate loan of HBL is classified

in two categories. They are:

|

Funded Facilities

·

Project

/ Consortium Loan

·

Non

Revolving Cash Credit

·

Working

Capital Financing

·

Overdraft

Facility

·

Demand

Loan

·

Revolving

Cash Credit

·

Import

Credit for Telex Transfer and Demand Draft Payment

·

Trust Receipt

Loan

·

Export

Credit Facilities

·

Pledge

Loan

·

Clean

Bills purchased and discounted

·

Documentary

Bills Purchased and Discounted

|

Non- funded facilities

·

Bank

Guarantee

·

Letters

of Credit

|

|

2. Retail/ Consumer Loan

·

Hire

Purchase Loan

·

Housing

Loan

·

Subidha

Loan

·

Credit

Card Loan

·

Loan

against Fixed Deposit Receipt

·

Loan

against Government Bonds & Bonds of Bank

·

Loan

against First Class Bank Guarantees

·

Loan

against Shares

|

3.

Small

and medium enterprises loan

(SME Loan)

Funded/Non-Funded

Facility in range of Rs. 0.5 M to Rs. 40.0 M

|

C.

International Banking (LC)

To assist its trading customers, HBL offers Letter of Credit (LC)

facilities. Customers can place their LC application in any of HBL branches.

The fees/ charges are one of the lowest amongst the commercial banks of Nepal.

The customers enjoy wide correspondent network of HBL in addition to attractive

rates.

D.

HIMAL Remit

Himalayan Bank Ltd. is a

pioneer in the field of retail money transfer business with over a decade long

customized service delivery experience in the field. HimalRemit is a

state-of-the-art web-based online money transfer system. It is easily

accessible through website of HBL. It can be directly accessed by all branches

and network thus ensuring prompt execution of the remittance. The product is

monitored and serviced 24/7 by Remittance Promotion Department of HBL dedicated

to deliver fast and reliable services to the customers. Himal Remit has the

largest payment network covering all cities, towns and villages of the country

and is capable of paying at more than thousand locations across Nepal which is

in ever growing trend as per the demand of local customers and service

providers.

E.

Safe Deposit Lockers

Looking at

the varying needs and wants of the customers, HBL offers locker facilities of

various sizes as per customer’s preference and convenience of location.

Customers availing of this facility enjoy not only peace of mind in terms of

security of their valuable belongings but also one of the most attractive rates

and ease of location.

Salient

Features:

· Temporary

Locker Facility for client Going Abroad Period: 3 months to less than 6 months

50 percent of annual charge

· Temporary

Locker Facility for client Going Abroad Period: 6 months to less than 1 year 75

percent of annual charge

· 25

percent Discount on Annual Rent to PSA Holders

· 100

percent rebate on key deposit and 50 percent on annual rent to HBL board of

members, chairman, advisor to BODs, staffs and their spouse.

F.

Cards Services

HBL provides various card facilities to the customers can withdraw cash

as well as purchase goods from several merchants. Customers use these cards at

any ATM terminal of HBL networks as well as SCT network also. HBL provides ATM

services to their customer, which is open 24 hours, a bay, 7 days a week, and

365 days a year. The cards facilities by HBL are:

·

ATMs

Card

·

Credit

Card (VISA/Master card)

·

Prepaid

Card

·

VISA

Debit Card

·

Master

card

G.

SMS Banking and E-Banking

SMS Banking

allows customers to check their balance, status of cheque (encashed or not),

HBL’s foreign exchange rate and contact numbers of branches. Through the

customer service department customers fill up the application form to apply for

these services. After fulfillment of the application form, the information

regarding customer are sent to the information department for further process.

After that pin number issued by the information department is provided to the

customer through the customer service department. By using E- Banking and SMS

Banking customer can make inquiry for balance and can get the mini statement by

using the electronics means and mobile by suing SMS.

3.8 HBL Branches and Networks

HBL have totaled 41 Branch

networks including branches inside and outside the valley which does

operational activities of the banks. Corporate office located at Kamaladi,

Kathmandu does all the management activities only. There are 40 ATM locations

inside Kathmandu valley and 26 outside Kathmandu Valley.

CHAPTER FOUR

ANALYSIS OF

ACTIVITIES DONE AND PROBLEM SOLVED

4.1 Introduction to

bills and remittance:

Remittance

in general means transfer of money from one place to another place. Bills and remittance department is concerned

with fund transfer, throughout the country and world, currency exchange,

issuance of draft, telex transfer, advance payments, collections and clearance

of cheques. Remittance is the flow of money from one economy to another, which

is sent by migrant workers. It can be both internal and external. Remittance

creates multiplier effect in domestic country. Money coming through remittance

increases investment and saving. Remittance also has positive effect on balance

of payment.

Generally, remittance

refers to that portion of migrants earnings sent from the migration destination

to the place of origin. Even though they can also be sent in kind, the term

‘remittance’ is normally limited to monetary and other cash transmitted by

migrant works to their families and communities.

Remittance

business was created by the foreign employment. These remittances are generally

used to cover day to day living expenses, to provide a cushion against

emergencies and making small investment. In developing countries like Nepal,

these remittances noticeably exceed foreign direct investment (FDI).therefore

the government should pay more and more attention in developing appropriate

strategies to remittance flows as important financial sources to boost economy

development. Simple process of fund transfer can be shown through following

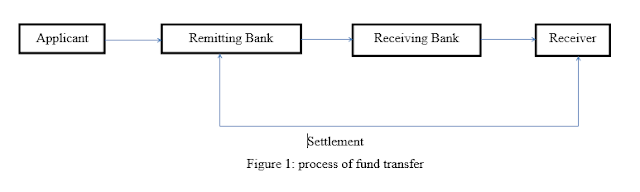

figure:

Figure 1: process of fund transfer

4.2 Types of Bills and Remittance:

The remittance can be divided into inward and outward remittance.

Similarly the bills can also be divided into same types.

4.2.1 Inward:

Funds being received in

Nepal from other countries are termed as inward remittance. The procedures are

discussed later in this chapter.

The HBL cheques that

customers has deposited in different other banks within the country are

collected through ECC. This is known as inward clearing. Cheques of HBL are

collected that has been deposited in various banks within city or in different

locations in the country. Similarly the cheques of HBL are deposited in

different foreign banks and this takes time to receive by the HBL, this is

inward collection.

4.2.2 Outward:

Funds being transfer to

other countries from Nepal in different means and purpose are known as outward

remittance.

Cheques of different

banks of the same cities in Nepal and from other locations are received in HBL.

These needs to be sent to the respective banks for clearance purpose and are

entered in the ECC with the details of the cheque. This is known as outward

clearing. Likewise various foreign banks’ cheques are received and being

impossible for clearance purpose, are collected and sent to the respective

banks through dispatch department. This is known as outward collections.

4.3 parties involved in Remittance:

While remitting the funds from one place to another, following

intermediaries plays crucial roles:

Remitter: Persons sending the money.

Remitting Bank: Remitters’ bank which

receives money from remitters and

Sends

the funds.

Paying Bank: Bank that receives message from remitting banks and

pays to the beneficiary.

Beneficiary: A person who is intended to receive money.

4.4 Instruments of Bills & Remittance department:

The instruments used in bills & remittance department of HBL are as

follows:

4.4.1 Demand Draft (DD):

A demand draft is an

instrument, which is drawn by one bank upon another bank for a specific sum of

money payable on demand. It is made by the bank and given to the purchaser

against cash or cheque. If two banks two banks are involved, then one bank

sends a DD to another bank. But in customer-bank case the customer sends

his/her DD to the receiver.

Demand draft is the bill

of exchange or cheque or drawn by bank in the name of the person or institution.

Amount of draft is paid to the person or institution through beneficiary bank.

Demand draft is cost effective as compared to other means of transfer.

Basic element of

draft:

Date: date on which draft has been

issued.

Drawer: issuing bank.

Drawee: bank on whom the draft has been

drawn.

Payee: final receipt of the proceeds of

the draft.

4.4.2 SWIFT transfer:

SWIFT stands for Society for Worldwide Inter-Bank Financial

Telecommunication, which was established in 1973 by 239 banks of 15 countries.

It is a bank owned cooperative society for transmitting financial message.

SWIFT is a reliable and effective communication network in terms of speed,

accuracy and security. It covers transactions like customer transfer,

documentary letter of credit cards, collection, FOREX confirmation etc. There

is no need of having an account with banks for fund transfers through SWIFT.

Funds can be received and transferred virtually anywhere in the world. Thus,

SWIFT can be taken as the modified version of TT messages.

HBL has established separate department as SWIFT since it has

various purpose in banking business. Bills and Remittance Department has a good

co-ordination with the SWIFT department.

4.4.3

Traveler’s cheque (TC)

Traveler’s cheques are used instead of

carrying cash. People prefer to carry TC for safety reason. Americans express

TC is available for sale. TC is in the nature of prepaid cheques issued by the

banks in a designated currency in fixed denomination cashable at a wide range

of location. At the time of encashment, the person has to sign in encasing

place and fill in the relevant data. Most well-known banks in the world have

issued TC in different currency.

4.4.4

Manager’s Cheque (MC):

It is a cheque drawn by HBL on itself,

especially used for payments made by HBL itself. Beneficiary can send the

cheque on collection and clearing or can deposit it customers’ account with HBL

itself. MC is one of the most secured modes of payment with primary liability

being that of issuing bank. It is ideal for making payments within country or

simply for transferring fund between the cities.

4.4.5

Telex Transfer (TT):

Telex Transfer is sometimes known as

telex telecommunications. It is the instrument for transferring the funds

quickly and securely within the country or anywhere in the globe. In TT, fund

is transferred electronically on the same day or next working day or with a

forward value date. HBL has facilitated customers in sending and receiving

funds by means of TT.

4.4.6

Collection:

Another important instrument of HBL

Bills & Remittance Department is collections. Cheques of various

international banks are dealt and the process is called collections. Collection

is similar to clearance of cheques. Various cheques of international banks in

various parts of world are difficult for clearance purpose so collection method

is used. In collection, cheques of different foreign banks and thoroughly

checked including its amounts, endorsements and stamps. After all required

verification they are sent to their respective banks and amounts are debited or

credited accordingly. The collection of HBL cheques from various countries is

inward collection and sending cheques of different banks around the world to

their respective destination is called outward collection.

It is difficult or nearly impossible to

establish clearing house for collection purpose. Thus for this the concept of

nostro and vostro account is essential elements of collection.

Nostro

accounts

HBL accounts maintained at the book of

other banks are Nostro accounts and corresponding accounts maintained at HBL’s

book to reflect of the activities of these Nostro account is termed as mirror

account.

Vostro

accounts

Other banks account maintained at the

HBL are termed as Vostro account. For example HBL’s USD account maintained at

Amex NY is Nostro account for HBL and same account is Vostro account for Amex

NY.

4.4.7

Clearance:

Modernizing

the Banking sector in Nepal is an essential strategic objective that Nepal

Rastra Bank seeks to realize by implementing an advanced cheque clearing

solution that manages the daily cheque clearing cycle electronically.

ECC is the state-of-the-art interbank

cheque clearing solution that has replaced the manual cheque clearing solution

in Nepal. It is an image-based, cost-effective, cheque clearing and settlement

solution, where the original paper cheques are transferred to scanned images in

order to be presented electronically through the secured communication channels

from the member in which they are deposited to the member on which they are

drawn resulting in a faster access to funds, lower transportation expenses and

increased cheque trust.

ECC calculates the multilateral net

clearing position and sends to the Settlement System of Nepal Rastra Bank for

settlement of the net clearing position of the direct member. The Central

System of the clearing mechanism lies at Nepal Clearing House Limited.

The

Clearing House main activities can be summarized as the following:

1.

Receiving cheques from presenting members for

outward clearing, and assuring the presented cheques validity.

2.

Transmitting cheques to respective Paying members for inward clearing

3. Receiving replied cheques and rejected

cheques from paying members

4. Transmitting replied cheques and returned

cheques to Presenting members.

5. Ending the clearing session of the current

business day.

6.

Generating the Net Clearing Position (NCP) and submitting the file to

NRB for settlement through the direct members’ accounts.

7. Starting a new clearing session.

4.8 Functional sections of remittance

department:

4.8.1

ID Payment Section

ID payment is the process of providing

cash to the customer that is received through remittance after verification of

receiver. It is a transfer of

money by a foreign

worker to his or her family or making domestic

payment. HBL has facility for both international payment (For Eg: Himal Remit

of HBL) and domestic payment (Domestic Money Transfer (DMT) facility by HBL).

The activities done in ID payment are:

· Entry

of rad no. on web based remit system to get remittance information under

various exchange houses such as Himal Remit, Western Union Money Transfer,

Money Gram, Choice Money Transfer, etc.

·

Verification

of the information of the remitter and beneficiary.

·

Photocopies

of customer Id

·

Recording

of remittance information

·

Forwarding

the verified information for cash payment.

·

Contacting

authorized personnel if problem arise.

4.8.2

Bills Collections Section

It does the all tasks related to

international banks cheque, traveler's cheque (TC) i.e. making TC and bills

purchase and collection, entry on Nostro and Vostro account, sending to

international bank about payment against TC, etc.

The activities done in bills collections are:

· Manual

entry of Traveler's Cheque, international cheques collection and purchase in

registers.

· Observation

of procedures for forwarding Traveler's Cheque.

· Stamping

Traveler's Cheque that are purchase and collected which are to be presented to

Americans Association for Traveler's Cheque.

4.8.3 Advance Payment of Credit Advice (APC) Section

APC does the transaction related to

transferring of funds from one account to another account but only receivable

of information of credited account that is done through SWIFT mechanism. It is

basically used by customer involved in exporting goods to receiver advance

payment for making supply.

The activities done in APC are:

·

Informing

customer about account credited.

·

Print

account movement advice and account payment advice.

·

Checking

statement of customer related to fund transfer.

·

Filing

of the bank copy of APC.

·

Observation

of account to account transfer entries by the employee.

4.8.4

Fixed

deposit and Fund transfer Section

i.

Fixed

deposit

Fixed deposit is the process of depositing

money that pays higher interest than a savings account but imposes conditions

on the amount, frequency, and/or period of withdrawals. It is also called time

deposits. Transaction related to fixed

deposit account of HBL were carried out by remittance department.

ii.

Fund

Transfer

It is transfer of fund from one place to

another through demand draft or telex transfer. Demand draft is a written payment order

from one party (the drawer) to

another (the drawee to pay a stated sum to a third party (the payee) by

issuing the cheque. Telex transfer is the mechanism in which bank transfer the

fund to another banks account in the request of customer. For e.g. Fees payment

of student reading abroad is done by telex.

The activities done in fixed deposit and fund transfer are:

·

Providing

different kinds of forms to customer such as demand draft forms, telex transfer

forms, fixed deposits forms, etc.

·

Filing

application forms and writing different application on behalf of customers on

the request of customers.

·

Recording

of fixed deposits account, demand draft transfer, and telex transfer, etc. in

the registers and filing the documents.

·

Writing

in the cheques using Cheque Writer.

·

Observation

of record keeping in the HBL software system (T24 software) by the employees.

4.8.5 Clearing Section

Clearing

section is one of the counters under the bills and remittance department where

both the inward and the outward cheques are handled. An individual might

receive payments via cheques of various banks. ECC (Electronic Cheques

Clearing) is a software mechanism that brings together all its members

(financial institutions) for clearings of the cheques. The cheques of those

financial institutions that are not the member of ECC are cleared in the

clearing section of the NRB.

The activities done in

clearing section are:

·

Receiving

the cheque for clearing and endorsing the cheque

·

Making

entry in the Globus system for clearing

·

Informing

the client in case of cheque return

·

Returning

the rejected cheque to the respective clients and maintain proper records

·

Handling

queries of the customer

·

Returning

the rejected cheque to the respective clients and maintain proper records

·

Handling

queries of the customer regarding their cheques sent for clearing.

·

Going

NRB for observation of clearing procedures carried out by banks.

CHAPTER FIVE

Conclusion AND lessons learnt

5.1 Conclusion

An internship

course of BBA has its own significance, which makes the students to complete

graduation in real world exposures of theoretical knowledge. Internship

provides the opportunity of gaining the practical knowledge and observing the

real application of theoretical aspects. Some facts about the privacy and

systematic approach of the organization were revealed. Internship has helped to

explore the fundamentals of baking system.

Coordination and

integration of various departments in banking systems is a must. Banking

organization is divided into various functional areas which are interlinked,

interconnected and interdependent with each other. If there are no team efforts

then no organization can achieve its organizational goals. Therefore, there

must be cooperation and support within the staff of the overall functional

areas to be successful.

The bank should

value the customer needs and solve the problems as soon as possible as tight

competition between them is taking a massive form. This helps to retain and

maintain existing customer by providing service up to their expectations. It

should take various customer feedbacks and provide them prompt and convenient

services. These were observed as an intern in HBL.

HBL has been

successful to create its own image within the country, and it is also

successful to create the banking relation with the most of the countries of the

world. It is capable to render its services necessary for export and import to

any businessperson of the world. Himal remit is an innovative product of HBL

and is being facilitating the customers as to match up their expectations. HBL

is playing a leading role in banking industry through its innovative products

and services that match the customer’s expectations.

5.2 Lesson Learnt

This internship report is based on

internship done at HBL, Thamel Branch from June 15, 2012 to August 13,

2012 to know the various

processes and working environment of banking in real life. I have gained lot of

experiences from the internship in HBL, which was my first experience in

banking sector. This internship program helps me to learn professional attitude

for future prospects and to learn practically apart from academic courses.

During this period, I was able to learn different services and products that

are delivered by bank, organizational culture, nature of organizational

problems, etc.

The lessons learnt are as follows:

·

Learnt about general banking operations.

·

Learnt overall basic functioning of the bank.

·

Learnt to co-operate in work place and to coordinate

the efforts of five sections of remittance department.

· Learnt to make good relations with co-workers,

seniors, corporate clients and general customers.

·

Learnt to adjust own self in various working

environment.

·

Learnt to adjust with the official norms.

·

Learnt to perform various activities

assigned.

·

Learnt how professionalism develops.

·

Learnt about the inter-relation and integration

of various departments in banking system.

·

Learnt general systems used in banking

information technology.

·

Learnt basics about NRB directions regarding

commercial banks.

· Learnt about authority and responsibility

relationship among various managerial and subordinate level in the hierarchy of

commercial banks.

·

Learnt about the overall norms and

organizational behavior regarding HBL.

EmoticonEmoticon